I spoke to a smart guy in the financial industry whom I have known for more than 20 years, and I asked him, “Do you think inflation is transitory?” His answer: Yes and no. Some of it probably will be transitory, but some of it definitely is not.

Here’s a boiled down version of his explanation:

Examples of Transitory Inflation

When prices rise because plant closures lead to shortages, because shipping costs escalate or for other reasons that we can expect to be cured in the next year to 18 months, then it is fair to call those transitory. For example, when more microchips reach the market, car and truck production will return to their traditional rates or better, and the number of new cars on dealer lots returns to a reasonable number. If supply and demand is the only reason for the increase in care prices, then car prices will stabilize.

Commodity prices may impact cars and other goods, but they always fluctuate. The cost thing things like iron and steel, copper, and will drop at some point in the future. Some would tell you that lumber prices are already dropping. Inflation related to raw materials is likely going to be transitory, or at least variable, year over year.

When the chicken production cycle speeds up, driven by the potential to make more money and the knowledge that the new chicken sandwiches offered by fast-food chains are here to stay, the availability of chicken wings and other pieces will increase and prices will drop.

Wage Inflation is not Transitory

Wage inflation, however, is not transitory. Here’s a scenario based on a real small business:

A company employing about 100 blue-collar workers paid new employees at $17 to $18 an hour prior to COVID-19. With unemployment paying out-of-work people about $16 an hour, they had to boost the starting pay for new workers to between $20 and $22 per hour just to attract applicants. You can guess how that went over with the existing workforce; they don’t want some new guy to make more than an experienced employee did. The company had to give all their existing employees a raise to “normalize” its payroll. The net result is that their payroll costs increased by 25 to 30 percent. That increases the FICA they have to pay, the unemployment taxes due, the amount of 401k matches they make, and how much they have to set aside for annual bonuses. It also creates a higher floor for future rises and cost-of-living increases.

Two things became clear: The company had to raise prices to cover their increased costs, and they don’t expect wages to ever return to those prior levels.

So while the price of copper may come down, the money they spend on employees is not. Neither will the cost increase they passed on to their customers.

When Transitory Becomes Permanent

If all we had was transitory inflation, then prices would probably drop again. But when you mix inflation, the non-transitory inflation is here to stay, and that drives all prices up. When that happens, we are unlikely to see inflation pull back. That’s in part because of what we call an inflationary spiral, when prices and compensation both grow in an ever-increasing spiral.

We are at the beginning of an inflationary spiral: The increased wage pressure has led to an increase in product costs. As product costs rise, employees demand higher wages to keep up their standard of living and to match the rising price pressure they see at the grocery store, the car lot, and the gas pump. The raises force the employers to increase prices, leading back to the original problem. The net result of offsetting raises and price increases leads to an inflationary spiral.

About the only way to stop it is to have a recession that sends prices plunging.

We Need is a Good Recession

We’ve all lived through multiple recessions, and they suck. Consumer spending falls, inventories build up, factory orders drop, and when businesses stop making things people get laid off. People lose their houses. Small business close. Weak businesses fail and companies declare bankruptcy. It becomes difficult for companies to borrow money or raise capital, so the growth or larger companies slows as well. The flood of foreclosures causes housing prices to fall, and people feel less wealthy because their house is worth less. The stock market also goes into a correction and loses anywhere up to 50 percent of its value.

In the long run, however, I prefer a good recession to spiraling inflation. A recession sets us back, but we can recover from a recession. Inflation, on the other hand, lasts forever because very few businesses will lower prices when their costs drop. A recession is temporary pain. The cost of a weaker currency is permanent and cumulative.

I think the current administration and Federal Reserve is going to keep spending, keep pumping, and continue to increase the deficit at a record pace. The inevitable result is easy to predict: Inflation that grows worse each year for several years.

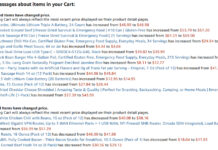

Keep prepping, folks. Inflation is ugly, and the more you have on your shelves, the better off you will be.