The 30-year mortgage exceeded 6 percent earlier this week, more than double last year’s rate. Although the repercussions have yet to be felt, that’s a huge blow to the economy. Let’s look at what this means:

The average cost of a new home in the U.S. is $348,079. To make the math easy, we’ll call it 350K.

The average down payment on a house is in the single digits, but let’s assume someone saved $35,000 to put down on their new $350,000 house. That’s 10 percent.

The leaves $315,00 to be financed.

The Numbers

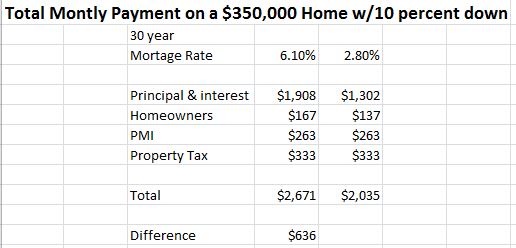

A 30-year mortgage at 6.1 percent on $315,000 results in a monthly payment of $1,908. But that’s just for the mortgage. Add homeowner’s insurance of $2,000 per year, PMI at 1 percent, and 4,000 annual property tax, and you get a monthly payment of $2,671. The calculation looks like this:

Today, it cost $636 more PER MONTH to buy a $350,000 house than it cost last year. That works out to be $7,632 per year. Which means a family needs roughly $30,000 more in income to afford a house at a 6.1 percent mortgage than they did at a 2.8% mortgage.

Alternatively, if the family still had the $35,000 down payment, they could buy a house for $250,000 instead, assuming they can find one that cheap.

Yes, the mortgage payment on a $350,000 house at a 2.8 percent rate is the same as the mortgage rate on a $250,000 house at 6.1 percent interest.

The Impact

As you can imagine, a $100,000 drop in buying power has a significant impact on the housing market and on people’s lives.

Fewer people will buy new homes. People who own homes will stay in them. Renters will be less likely to buy a house of their own.

The inventory of houses on the market will climb. This is already happening. The law of supply and demand will kick in and housing prices will drop. Will a $350,000 house become a $250,000 house? Not right away. Maybe never, unless a bank owns it or it gets auctioned off.

People desperate to sell their home will have to lower their price to get it to move. Some of them will be underwater, meaning they can’t sell the house at a high enough price to pay off their mortgage.

Homeowners will suddenly have less equity. I’ve been there. The house I bought in 2002 grew in value for five years. Then it crashed during the 2008 recession. It took until 2012 to get back to the value at which I purchased it.

Here’s the worst part: People who get laid off during the recession will no longer be able to make their mortgage payments. They will try to sell their house, but one will buy it at the price they need to pay off their mortgage. Unless the government forces banks to stop foreclosures (again), they will face foreclosure. They will not only lose what they thought (last year) was a nice chunk of equity, they will lose their initial down payment and their good credit report. They may have to declare bankruptcy. It will take them years to recover.

Beyond Housing

When people feel less wealthy, when they feel stressed about the economy, they spend less. Because consumer spending is a large part of the GDP, that just extends the recession.

If you were paying attention fifteen years ago, you should remember the effects of a housing crash. Neighborhoods with an abandoned house on every street, complete with boarded-up windows and un-mowed lawns. A stock market collapse. The loss of trillions of dollars of wealth once held by middle-class Americans. What we now know as the “Great Recession.”

And through all that pain and economic suffering, we didn’t have to worry about high interest rates and inflation. This time around, it’s could be even worse.

The cabal is going to succeed in taking down the United States, I assure you that. They WILL win. You will own nothing, but you sure as hell won’t be happy….

Comments are closed.