It’s looking more and more like the U.S. will not face a recession this year, which means we will see more inflation. Given the plight of our current economy, the alternative is one or the other; we have too much debt and spend too much for the economy to settle down on its own.

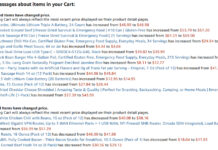

A recession would cool off the economy and let things return to what passes for normal. It would come at a cost, of course, meaning companies would fail, people would lose their jobs, the stock market would fall, housing values would drop, cars would be repossessed and homes foreclosed. Instead of a recession, the Fed and the government are going to bring us more inflation. If you don’t believe me, look at the cost of food and goods you buy on a day-to-day basis.

For example, the big cookies I used to buy at Sheetz (a gas station and convenience store) for $1 are now $2.19. If you buy two at a time, they’ll sell them to you for $4. You’re supposed to think you are saving 38 cents, but in reality, your spending has doubled in two years.

While the rate at which inflation is growing is down from the peak of 9.2 percent it hit last year, inflation is cumulative. If we finish this year with 4.5 percent inflation, it will be in addition to last’ year’s inflation, not instead of. In other words, the price on those cookies might not go up another dollar, but they sure aren’t dropping back to $1. Unless we get a big wave of deflation, costs are going to keep rising. So when someone tells you “inflation is dropping,” remind that in 2022 it was at a 40-year record high, and while it may be growing slower, inflation is not dropping.

See Sawing Rates of Inflation

We may be entering a period like the Great Inflation of the 1970s when inflation saw peaks and valleys before climbing as high as 15 percent in the early 1980s. Rates fluctuated for a decade, but inflation never went away until Paul Volker took over the Fed and jacked up the Fed Funds rate to 19 percent in 1981. This rate was so high the country fell into a brutal recession that lasted until 1983, but in the long run, it brought some stability.

Just as we saw in the 1970s, the government is taking steps designed to lower inflation. Many of these steps will work to a certain degree, but their impact will dissipate. The momentum of inflation will overpower small steps.

Inflation was kicked off by two things: a lack of goods caused by supply chain issues brought on by the pandemic lockdowns, combined with the government’s creation and distribution of new money. Money creation includes both quantitative easing and giving “free” money to consumers. The giveaways included checks sent to most Americans, funding for 18 months of unemployment, and programs designed to support small businesses, airlines, and other industries. This lead to more and more money chasing fewer goods, which is almost a text book definition of inflation.

Russia’s invasion of Ukraine, which caused a spike in energy and food prices, further exacerbated inflation. This combination of easy money plus shortages overwhelmed the economy and caught the regulators off guard. The result was inflation pressure on multiple fronts.

Stopping inflation with one or two actions is like Hercules fighting the hydra. You smash one head and two others pop up. So prepare for a lengthy battle with many ups and downs. Until we get hit with a strong recession, we’ll be facing inflation.

Gold and the Dollar

Lately, there has been much speculation about how the disruption of the U.S. economy will affect the value of the dollar. This leads to concern about whether the dollar may lose its position as the world’s reserve currency. The BRIC countries are considering offering a gold-backed currency, which some say could threaten the dollar’s role as the preferred currency for global trade.

While the idea of a gold-backed currency sounds good, there is not enough gold available to support one. At the end of 2022, the world’s central banks held 35,715 tonnes of gold, or about 1.15 billion ounces. Right now, one ounce of gold is worth about $1,960. That means they own $2.25 trillion dollars’ worth of gold.

If you use the M2 measure of money supply, there are $21.2 trillion dollars in existence, about ten times the amount of gold owned by all the central banks in the world, not just those in the BRICS countries. The world’s GDP is over $96 trillion. Given those numbers, how can the BRICS, or any nation, create a gold-back currency that could be used in global commerce? The only answer appears to be, the gold won’t fully back the currency. The new currency, let’s call it a Brick, will have only a small fraction of its value backed by gold. Let’s be generous and say gold backs 10 percent of its value.

So if you want to convert your paper Brick into gold, you would only get a tiny fraction of the currency’s worth. I don’t see that winning over many converts.

Currency Requires Trust

Trust is necessary for a successful global currency. For example, when a company in the U.S. wires money to Europe or China, or vice versa, the system works in a large part because of trust and systems. The companies trust the transaction, which is handled by a system called SWIFT. The banks likewise must trust that the bank that sent them funds, and that SWIFT isn’t being spoofed. All parties have to trust the value of the currency.

One reason the BRICS are losing trust in the dollar is that the U.S. is shutting countries and banks out of the SWIFT system as punishment, thus breaking the very principles on which the system is built. Bad call, in my opinion.

But it raises an important issue: Will other countries and companies—outside of Iran, North Korea and the like—trust the new BRICS system?

Furthermore, will the world trust Russia and China to hold the gold that backs the Brick? Who will audit their depositories? We don’t trust China’s economic announcements now; why would the world trust their claims regarding bullion depositories? And what happens if Russian oligarchs or corrupt leaders loot their depository? It would not be the first time a ruler has run off with his country’s wealth.

Will Saudi Arabia sell China oil in return for paper money that is backed by a fraction of its value in gold? Why, when they could just ask for payment in gold instead and get 100 percent gold? Sure, shipping around pallets of gold is a pain in the ass and a security risk, but it’s already being done.

Let’s say the new Brick is backed with 10 percent of its value in gold. What happens when Russia, or Brazil, or China need some more money and they print or magically create more Bricks to pay their bills? If they don’t have additional gold set aside to back those new Brucks, the amount of gold backing the currency will decline. That will lead to inflation.

What’s it Mean to You and Me

The English Pound was the world’s reserve currency until the end of WWII. The UK is still around and still a world power (albeit with fewer colonies) despite it. I expect we would remain a world power, although less of one, be if the dollar lost its position.

The actual loss comes would be in the flexibility the U.S. gets by having the currency everyone wants, and the knowledge that there is a ready market of people who must buy or borrow dollars to conduct commerce. It gives us a position of strength. If we lose this position, which won’t happen overnight unless there is a massive economic collapse, prices for foreign goods might increase. Yet another reason to manufacture more goods here in the U.S.

If you are at all worried about the state of the U.S. Dollar, other currencies challenging the dollar’s position, the U.S. economy, or inflation, the best thing you can do is buy and hold gold. Gold will protect you during inflation. It will protect you in an economic collapse. If a gold-backed security becomes accepted on a global level, your gold will probably grow in value. And if you lose your job in a recession, you can sell some gold to pay your bills.

And if you can’t afford gold, buy silver. It offers many of the same benefits and is about $24 per ounce instead of $1960. That makes it easier to accumulate, or stack.

If precious metals scare you but you have extra cash, considering putting it in a CD. High quality 90-day CDs are earning between 5 and 5.25 percent. You may still lose money when you consider inflation, but you won’t lose as much as you do leaving it in your savings account.

Just a reminder: I am not a financial advisor or financial professional and this should not be considered financial advice. Do your own research and consider talking to a financial professional before making investment decisions.