Dollar General shares tumbled more than 25 percent after its latest earnings announcement, in which it reported its customer base—generally made up of people on the lower segment of the economic scale—were “feel financially constrained.”

Looks to me like another case of Bidenomics gone bad.

How big is Dollar General? They have 18,912 locations. I know it is popular in our state. They are liberally sprinkled across our economically challenged county, and every small town seems to have one.

If that wasn’t bad enough, it is being reported that Big Lots, another chain of stores that attracts shoppers looking for a bargain, may be close to declaring bankruptcy.

It’s not just those on the bottom rung that are spending less. Sales at Lululemon and Ulta Beauty missed projections, gave gloomy forecasts for 2025, and saw share prices suffer. My interpretation of this news is young women, many of them professionals, are also cutting back on spending.

People Spending Less…

On August 14, I posted “Consumers are Pulling Back on Discretionary Spending.” When people pull back, companies experience lower sales, which translate into lower share prices. It’s one of the first obvious signs of an economic slowdown or recession.

You might expect low-wage earners to have a hard time making ends meet, but that’s not the demographic that wears Lululemon yoga pants and buys Ulta Beauty products. Their slowing sales demonstrate that the financial pain is being felt at higher levels on the economic ladder. I guess even Instagram and TikTok influences can’t entice people to spend money they don’t have.

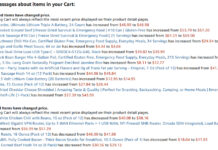

That’s what it comes down to: people are running out of money before the end of the month. But it’s more than that. They’ve been running out of money for months, even years, as inflation eroded their buying power. Now they are running out of credit. Their cards are tapped out, and even the companies that grant them instant credit, so they can spread a $100 purchase out over four months, are thinking twice about lending to them. Then again, no one should put their groceries on their credit card unless they pay off their balance every month.

…And Owing More

Credit card debt is now to $1.17 trillion, its highest level ever. Car repos are up 23 percent this year over 2023 because more people can’t make their payments. Home equity lines of credit (HELOC) are also at their highest level, meaning more people are tapping into the equity in their homes to help pay for everyday expenses. That’s a dangerous trend because it makes it more likely you will lose your home if you lose your job. Americans have $4.9 trillion in household debt, not counting what they owe on their mortgage. If you do the math, that means the average debt load is about $16,000 per adult living in the U.S.

If you add in mortgage debt and the aforementioned HELOCs, you have another $12.9 trillion owed. That breaks down to roughly $250,000 in mortgage debt for each of the 52 million homes that carry a mortgage.

The monthly payments required to service debt—whether $700 for a new car, $1,000 for outstanding credit card bills, $2,700 for a mortgage payment, or some combination of all three—are what is making the average American unable to afford to go out to dinner or buy Lululemon shirts, and is forcing them cut back on day-to-day expenses.

The American Dream is getting more and more expensive and no doubt looks unattainable to many.