The last time I put gas in my car, the price in our area had jumped 20 cents, about 7 percent, from my fill up two weeks prior. I consider that a warning shot across my bow, signifying that inflation is making a comeback.

Higher fuel costs not only hit consumers when they put fuel in their tank, but drive up the prices of everything that is transported by truck. Even UPS and Fedex have fuel surcharges which get passed on to their customers and then—you guessed it—on to you in terms of higher shipping or more expensive goods. (There is no such thing as free shipping even if the website says so—they build the shipping cost into the item price.)

The bad news of rising gas prices is not the only sign of inflation. Last week, reports said wholesale prices rose 0.6 percent in February. As those of you who can perform math have already figured out, a 0.6 percent monthly increase means wholesale inflation rose at a 7.2 percent annual pace last month. And wholesale price increases eventually get passed on to retail customers, often with an added bump so retailers can preserve their margins.

Gold and silver prices are also climbing, meaning the value of a dollar is dropping. The metals market seems to be pricing inflation in. Another warning shot.

In short, expect oil prices to keep climbing, and prepare for food and other day-to-day living costs to increase as well.

Sadly, as long as Uncle Sam keeps creating money to fund its spending, we’re stuck with inflation and the economy will sputter.

That Old ‘70s Feeling

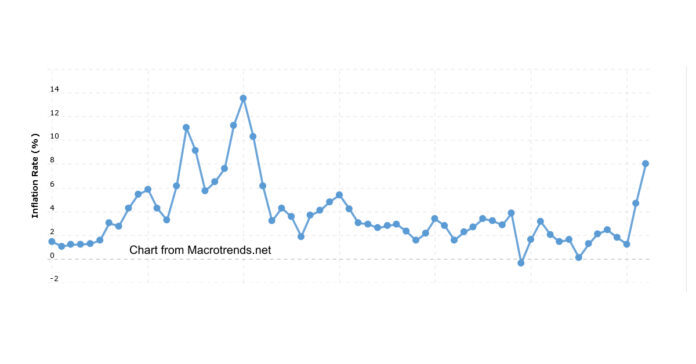

In the 1970s, inflation rose and fell repeatedly. In 1970, it reached 5.84 percent, then by 1972 it dropped to 3.27, only to jump back up to 11.05 percent two years later. Then it receded to 5.74 in 1976 before shooting up to 13.55 percent in 1980.

Five decades later, that cycle may repeat itself, meaning we have recurring bouts of inflation to look forward to. Don’t get complacent. Don’t allow the talking heads to convince you the Fed will cut rates later this year. They may, but then again, they may not. (In fact, they probably shouldn’t but may feel pressured to do so because it is an election year.)

Take advantage of periods of lower inflation in between the peaks to lock in mortgage rates. Then profit from higher rates a year or two later with CDs and other investments that offer higher earnings when rates increase. If you are saving up for something big, buy it before rates jump.

Remember 2022?

You don’t have to look back to the 1970s to see the pain inflation causes. We dealt with 8 percent inflation just two years ago. Think back to 2022 when it seemed everything cost more each week and your paycheck wasn’t keeping up. Prepare for that to happen again.

How do you prepare? Buy consumables with a long shelf life so you can delay or defer buying them when prices peak. For example, I saw bacon prices more than double before they dropped back down, but I had purchased 12 pounds before the price increase and stuffed it in the freezer. Even bath soap got more expensive, but we had a large package from Costco. Stock up on paper goods, health and beauty aids, hygiene products, and other items you use regularly but have long shelf lives.

You can also prepare for inflation and TEOTWAWKI by buying canned food, which has a multi-year shelf life. I recommend you eat the food you bought back in 2020 and 2021 and replenish your stockpile with fresh cans.

It also remains a good time to buy guns and ammo as supplies are high and prices are moderate. (9mm ammo is cheap but 5.56 has not returned to its prior lows.) If Biden gets elected again or if there is civil unrest, gun sales might accelerate and ammo could become scarce. Prepare now, before your buying power drops.

Tangible Goods

Of course, one of the best tangible items to buy before inflation hits is real estate. If you have money, land will help you preserve your wealth. The only challenge is that 30-year mortgage rates are 7 percent or higher.

Even so, we have friends outside Nashville who are considering moving. Their Realtor told them every house up for sale in their neighborhood in the past year has sold in less than ten days. So while interest rates and home prices are much higher than in 2019, they could be better buying today than they will be in six months or in two years.

Of course, just as I can’t predict home prices, I can’t predict inflation. But I can only say we’ve seen this before in the 1970s. I remember my mother’s frustration when hamburger climbed above $1 a pound. I sat in gas lines waiting to fill up the car. Looking back, I realize there were years when we ate a lot of hot dogs and baked beans. We installed a wood stove and heated with wood instead of oil, and all our vacations included camping because it was less expensive that staying in a hotel.

If you are flying on vacation to places you can barely afford, eating at restaurants that are increasingly expensive, and putting your grocery bill on your credit card, maybe you should take a tip from my parents and live a more frugal life. If inflation doesn’t hit, you’ll find yourself in better financial shape than you expected and chances are you won’t miss any of the things you used to do.

I know I don’t.

Please keep in mind that I am not a financial advisor and the comments above are my observations, not financial advice or recommendations. Consult an investment, real estate professional or other advisor before making financial decisions.

Your articles are good, thanks!

Comments are closed.