Reading the mainstream media, the alternative media, the business media, and the financial press, it is impossible to find a consistent message on whether a recession or an economic boom is coming.

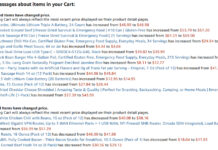

There are doom and gloomers who would tell you we are already in a recession, and the Biden Administration lied and falsified data as a re-election tactic. This, they predict, will come back to make Trump look bad when his administration publishes the real numbers. Just like the CPI “jumped” in January, we may see more bad economic news when the fake data is backed out, as it often is months later for job reports.

Some economists will say we are already in bad economic times compared to “normal,” but we are better off than other countries. Don’t confuse being stronger with being strong enough, they say. Others think the new administration heralds a financial golden era.

Meanwhile, traders are shorting stocks, hoping to make money when the market falls. Instead, they get squeezed when it rises, which forces prices up even higher. Someone is making money in the market, but it probably isn’t you and me.

Central banks are buying gold, trying to get their reserves out of dollars and into something with real, lasting value. This is causing run on gold in the LBMA, the Bank of England’s gold vault. They may not have enough physical gold to meet withdrawal demands.

Complicating this scenario are rumors the United States may revalue its gold, which is currently on its books at a paltry $45 an ounce. Gold is trading at 65 times as much on the market. No one knows what a re-evaluation would mean to the market, but everyone has theories. My theory is this speculation is driving up the price of gold to new highs.

Volatility

Two weeks ago, I said Trump was going to be disruptive. Not only are his ideas shattering the old system, they are coming so fast and furiously it is difficult for people to adapt to them. That results in disruption. Disruption results in financial volatility as the market swings from excitement to fear and back.

Just look at how his financial cuts and freezes are disrupting Washington and how his foreign policy is disrupting the world. No wonder no one knows what the economy is doing. They haven’t had time to slow down and analyze the changes.

As preppers, disruption shouldn’t frighten us. We prepare for the unexpected, for the worst-case. Just keep preparing for it, and let the Trump-inspired chips fall where they may. Let the market be the market—you can’t influence it and worrying accomplishes nothing. Have your food, your water, your shelter and your other fundamentals. Aim to have job security; put some cash under your pillow and some junk silver in your gun safe. Pay down your debts and minimize your expenses. Be prepared to protect yourself and your loved ones, to get out while he sh*t is still heading towards the fan, or to hunker down and outlast the problem.

Preparation

One way to look at prepping is to use the excesses of the good times to set the stage to get through the bad times so you can pick up where you left off when the good times roll around again. For example, when I lost my job, I got a new one. When my 401k sank in value, it eventually recovered and reached new heights. My house dropped in value in 2008, but it had soared by the time I sold in 2020.

Whether it is boom or bust; inflation, deflation, or stagflation; high interest rates or low interest rates; $10 eggs or $8 gasoline, be prepared and patient enough to weather the financial storm and come out the other side in one piece. Whatever happens won’t last forever. The economy changes, sometimes for the worse, sometimes for the better, but it is rarely stagnant. We live in a cyclical world, and when you reach my age, you will have seen enough rotations to shrug and carry on.

So prep, say the serenity prayer, and carry on through whatever fate or the economy hands you.