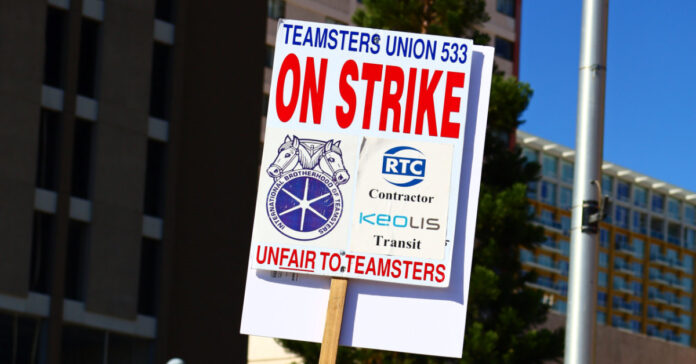

Suddenly, Unions have the power again. For example, rather than suffer a debilitating strike and potentially losing business that it might never recover, UPS reached an agreement with the Teamsters that gave full time drivers $49 an hour. Separately, a strike threat by the Teamsters was the final straw that broke Yellow Freight. (For the record, Yellow Freight had multiple problems; the Teamsters were just one.)

Now 97 percent of workers at Ford, General Motors, and Stellantis have voted to authorize a strike. This gives the big three automakers until September 14, when the contract runs out, to put a winning offer on the table or face seeing their factories grind to a haul. The union is asking for a 46 percent pay increase and a reduced work week.

The union is unlikely to get that, but you can be sure they will still wind up with a healthy contract. Why? Because companies have been raising prices with inflation while employees’ wages are largely stagnant. So while groceries, gasoline, and the electric bill are up 20 or 30 percent since these deals were last negotiated, wages have not. As a result, there are enough angry workers to make sure strikes happen at these unionized companies. That 97 percent number speaks for itself.

The Inflation Cycle

Unfortunately for the rest of us, higher wages generally translate into higher inflation for two reasons: First, companies have to raise prices so they can afford to pay their employees more. Second, employees with more money in their paycheck buy more, adding demand, which also dries up prices. The inflation doom loop is that this, in turn, causes employees to demand higher pay in the next round of negotiations. It can become a multi-year, seemingly unending cycle.

A recession would break the cycle, but the Fed is trying to avoid a recession to give Joe Biden has a better chance at re-election.

Curiously, while the Fed tries to prevent a recession, the Biden Administration just banned drilling for oil on even more land. Their policies have seen leading economic indicators fall for 16 months in a row. People are also running up credit card debt, a sign they cannot afford life and are buying everything from groceries to back-to-school supplies on credit, which they cannot pay off.

Non-Union Employees

What’s a non-union employee to do since they lack a union? The best way to get a raise is to change jobs. Of course, that can cost you seniority. If a company fires the most recently hired first, that could hurt you. It might also affect your vesting in a 401k or other retirement programs. Still, if you’re making $53,000 annually and you accept a position paying $75,000, then such a move makes sense.

As important as salary is, things like working hours, work/life balance, flexibility, and working for a boss and with people you like also matters. Of course, if you can’t pay your rent without a pay increase, work/life balance goes out the window.

Employees are demanding 22 percent more pay than they did before the COVID pandemic. A recent article reported employers are offering 14 percent more than they did last year, to entice someone to change jobs, a record high.

Planning for Retirement

Retirees and others on fixed incomes don’t have the option of changing jobs or asking for more. Their only option is to go back to work or cut back on expenditures. This often means less travel, fewer gifts to children and grandchildren, and downsizing their housing.

Worse, the older they get, the further behind their standard of living falls because their social security and other pension payments fail to keep up with inflation.

If you have not yet retired, the best way to prevent running out of money during retirement is to have additional investments, so you are not reliant on fixed payment programs. Max out your 401k and IRA contributions, but also look at alternative investments like real estate and precious metals. Consider starting a side gig or business that can generate income.

Prepare for More Inflation

During the 1970s, inflation fluttered up and down before peaking in the early ‘80s. The 2020s may see the same up-and-down cycle where inflation never goes away, just bounces. That’s bad news for consumers.

One way to prepare for more inflation is to live below your means. Cut your standard of living now, stop trying to keep up with the Jones, and refuse to go into debt for anything but your mortgage. Learn to cook from scratch instead of eating out or buying prepared foods. When prices rise, you’ll have a financial cushion and the skills to adapt to higher prices.

Save money, make investments, and live frugally. Frugal living can be as simple as paying cash for a gasoline-powered car and keeping it at least ten or twelve years. Shop carefully and buy when prices are low. Stockpiling foods and goods will not only protect you from prices increases, it will build your preps.

If you are in a union, this is the time to demand higher wages that keep up with or exceed inflation. For those not in a union, put some gentle pressure on your employer. If they don’t respond, start looking for alternative employment. Every penny counts.