Between politics, the economy, and world affairs, it’s looking pretty ugly out there.

Back on March 4, I wrote about how the war in Ukraine appears to be escalating. Since then, it seems to be getting even worse. There are reports and photos of large numbers of U.S. tanks, self-propelled artillery, and Bradley armored vehicles arriving in Europe. The Third Armored Brigade is heading to Poland where it will train with NATO and help “deter” Russia. This is on the heels of a massive NATO training exercise that brought together 90,000 troops.

At the same time, NATO is expanding airfields, and the U.S. has spent the past year rehabbing the Basa Air Base and four other bases in the Philippines. There are also an increased number of military flights moving men and material all around the globe.

In Europe, countries are not only building and buying armaments, some are said to be considering restarting the draft. The head of the British Army implied this recently, leading to the civilian government to quickly say it has no plans for conscription. Of course, we all know plans can and do change.

Whether we are planning to start it or simply want to be prepared when one starts is unclear, but war preparations are growing. Not only in Europe, but in the South China Sea and in the Middle East.

Here at home, you should prepare for war as well. Not necessarily to fight in one, but to survive its economic impact, supply chain disruption, and inevitable changes in inflicts on our domestic policies.

Politics of Division

The domestic political scene doesn’t look any better. No matter what you think about one or both of the presidential candidates, we are seeing more corruption, more bitterness and anger, and more division. No matter who wins, half the country is going to be pissed, and there’s a good chance we’ll see civil unrest after the election.

The first election I remember was between George McGovern and Richard Nixon back in 1972. Of course, that proved to be an election of “dirty tricks” and while Nixon won in a landslide, he later paid the price and was forced to resign before his impeachment trial. Fifty years ago, that was shocking. Today, presidents seem to get impeached every few years, like it’s just a cost of doing business. In actuality, I think it is an example of the lack of partisanship and a deterioration of the polite society that may have once existed on Capitol Hill.

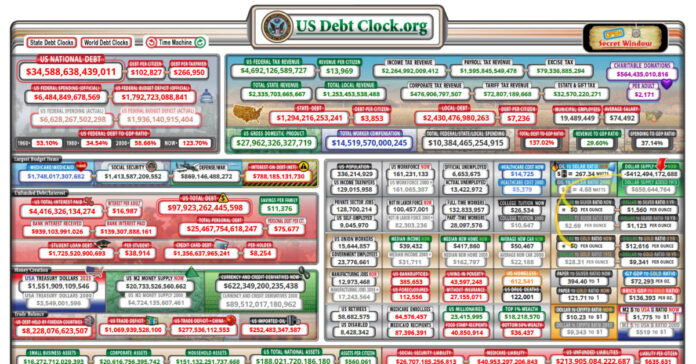

Politics today has also led to the practice of buying votes from a certain group by making promises, and using tax money taken from the losers to benefit people favored by the winners. Throughout history, this approach has brought down many a government and collapsed many a society. As Margret Thatcher said, “The problem with socialism is that you eventually run out of other people’s money.” All you have to do is look at the debt clock and you can see it ran out a long time ago. Now we are borrowing to sustain what will soon prove to be unsustainable programs.

Financial Issues

Meanwhile, people are hurting. They can’t afford a house. They have crippling credit card debt totaling $1.36 trillion and accruing at annual interest rates over 20 percent. New cars now take seven or eight years to pay off, and college degrees take even longer. Food is growing more expensive. Gasoline jumped another ten cents per gallon since Monday’s post.

Companies are also laying people off. Stores are closing, including 600 Family Dollar stores. Big brands are hurting. Crime is up, and the ATF is shooting people in the head on break-of-dawn raids.

But the S&P 500 is up 27 percent since October 26, meaning people with lots of money in the market are seeing their net worth increase. Of course, these aren’t the people struggling to put food on the table. Meanwhile, I am waiting for the other shoe to drop. This run up seems like a head fake; I don’t think it can last. But who knows? This isn’t a predictable, rational market.

What will happen if the Fed doesn’t drop interest rates? Or, perhaps worse yet, what will happen when it does? What will happen when inflation comes back, as I mentioned earlier this week? We may be headed back to an economy of the 1970s while we gear up for a war like it was the late 1930s.

Gold and silver have also been on a tear, but that just means the dollar is dropping and central banks around the world are selling dollars to buy gold. They see the writing on the wall. Do you?

Pessimism

Maybe being sick this week has made me a pessimist. Perhaps I watched too much YouTube and read too many online news articles while I was stuck inside, afraid to venture outside a 20-foot radius of the nearest bathroom. Maybe I’ll feel better if I go outside and enjoy a spring day.

That might help my mood, but I don’t think it will slow our descent. TEOWAWKI is getting closer, and all we can do is prep for it.