On Friday, gold hit a new high, surpassing the previous high set the day before. What, if anything, can we learn, deduct, or infer from a year in which gold has climbed from $2063.73 to $2588.19, an increase of $524.46 or 25.4 percent?

The price increase appears to be driven by massive buying by central banks in China, Russia, Saudi Arabia and other countries. Professional and retail investors may also be buying gold, further driving up demand of both physical gold and paper gold.

The obvious deduction from this is institutions and individuals looking to protect their wealth—from central bankers and other elites all the way down to the man on the street—are concerned about the stability of the dollar and the global financial system. They buy and hold gold as a hedge. If the dollar collapses and becomes worth less (or even worthless), owning gold gives countries and individuals an alternative way to preserve and even spend their wealth without using dollars.

The BRICs nations may also look at building their gold reserves to diversify out of their dollar reserves or to add some backing and legitimacy to some new currency. Countries that are potential enemies with the U.S., or are already subject to sanctions, may see gold as a way to get their reserves out of funds the U.S. can control by shutting their banks out of the SWIFT system.

Gold has always been money. If the dollar disappears or cannot be used by China, for example, they want to have something of value that is universally accepted. Gold fills that niche.

Debt, Interest and Money Printing

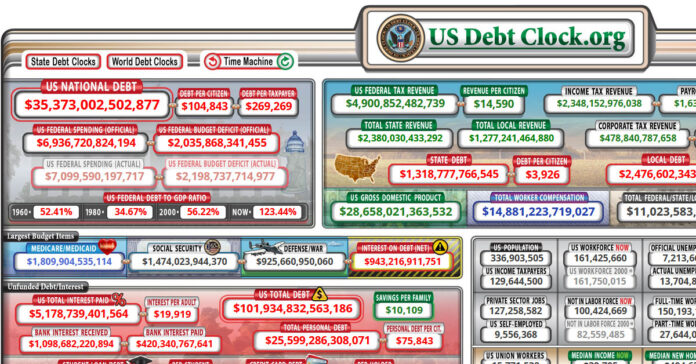

The United States’ national debt is currently $35.4 trillion dollars, and the government is required to pay more than $1 trillion in interest just to keep from defaulting on the debt. The government is spending $6.9 trillion this year, $2 trillion more than it collected in taxes. That means the national debt will continue to grow.

As bad as those numbers look, it gets worse. Social Security and Medicare have combined liabilities of about $69 trillion. Add in all the other unfunded liabilities, and the U.S. has $219 trillion in unfunded liabilities. That means the country needs to do one of two things: raise trillions of dollar or stop spending trillions of dollars. The catch-22 is that either one will throw the economy into a recession, which politicians don’t want.

Instead of making the hard choice and causing some short-term pain, the government will just borrow more money. When investors become too smart to loan it to them, the Federal Reserve will do so. Where will this money come from? Out of thin air. The Fed will loan it into existence with a few clicks on the keyboard. That sounds like a simple solution, but this kind of increase in the money supply is what causes inflation. That’s the reason a $100 bill today will buy only one fourth of what it bought when I graduated from high school.

Recession, Depression, and Default

One solution people don’t like to mention is default. Instead of printing new money, the government could refuse to pay back those loans, leaving everyone who is holding government bonds and bills with a giant hole in their wallet. A default is unlikely and would have a catastrophic impact on the global financial market. You could consider it a worst-case scenario, outside of another World War.

Those are the reasons people and countries are stockpiling gold. Out of fear. Fear of an economic collapse and fear of war.

In a recession or depression, we tend to see deflation, which will decrease the value of gold. Most gold holders will take that risk because gold increases in value during inflation. They see it as an insurance policy with a value that increases or decreases in line with the value of the goods they are insuring.

Local coin shops are reporting a high number of customers cashing in gold and silver. Some are doing so because gold is at an all-time high, but most are reportedly cashing out because they need the money. With credit card debt at record highs and savings down from previous levels, people who need money to pay their bills or for an emergency are cashing in their stash of precious metals. When people start cashing in their last resort, it can be considered a warning sign.

Sterling Silver and Gold Scrap

If money is tight, this could be a good time to sell your sterling silver flatware or old gold jewelry.

With silver flirting with $31 an ounce, the set of sterling silver flatware you inherited from grandma could be worth between $1,000 and $2,000 dollars, depending on how many pieces you have and where you sell it. Add in sterling serving platters, salt sellers, a cream and sugar set, a gravy boat, a tureen, candle sticks and other sterling items and you could have a mortgage payment or a few car payments sitting on a shelf collecting dust.

If you have old or outdated gold jewelry you never wear, a piece or two you inherited, an item with a broken chain or clasp, or a single earring missing is mate, they may be worth even more.

Back when gold was closer to $2,000 an ounce, I took scrap jewelry to the pawn shop and got over $1,400 for it. If I had waited until today, I would have gotten closer to $1,700 because the price of gold is higher than it was.

Citibank says gold might reach $3,000 by the end of the year, which means trading in your scrap could get you even more money in December than it does now. I guess it just depends how much you need the cash. Given gold’s track record so far this year and the prospects of an ugly election, I find the $3,000 prediction more likely than many of the outrageous predictions of $10,000 or more. But keep in mind that if we see a recession, precious metals prices could drop. Of course, that could result in a buying opportunity. I am planning to buy some gold in2025, so I am hoping the price drops. I’m going to be unhappy if I have to buy it at $3,000 an ounce and I could have bought it at $2,500.

Watch out for Fraud and Scams

When dealing with gold, silver, other precious metals, or other valuable assets (from art to baseball cards), educate yourself before doing any buying or selling. If you go into a pawn shop with a 14 karat gold chain worth $1,500 and they ask, “What were you looking to get out of this?” and you say, “I was hoping for $600,” you could be missing out.

For example, the store could say, “It’s worth more than that. I’ll tell you what, I’ll give you $750.”

You leave the store thinking, “Wow, what a nice guy. I’m going to go there again.”

Meanwhile, he’s thinking, “Wow, what a sucker. I hope he comes in again.”

You should also be alert for scams. If someone tries to sell you a thick “gold” chain for $200 at a gas station or in the parking lot outside Walmart, just say no, regardless of how desperate they appear to be. The chain may even be stamped 14K or 18K, but it’s a fake they purchased it online from China for $4.99. The scammer is trying to take advantage of your greed. You think you are getting a great deal on an expensive gold chain, but in reality they are pulling the wool over your eyes. You won’t know how badly you were duped until you try to sell the chain.

There are also lots of fake silver coins and gold bars out there. Buy from reputable dealers and have a way to test and confirm the products you are buying. Even old Morgan and Peace silver dollars are often faked, so if you see a $25 or $30 coin at a flea market for $10, don’t be fooled.

Before investing with a third party, consider this cautionary tale about a California company that appears to have run off with all the money people sent it for gold IRAs.

Disclaimer

Since we’re talking about frauds and scams, please know I am not a financial advisor, accountant, tax professional, lawyer or an expert in precious metals. All I am is an educated prepper relaying my personal beliefs built up over more than 30 years of prepping experience. Do your own research and consider consulting a financial professional before making any financial decisions, including those related to buying or selling gold.

In the meantime, watch the financial markets, watch what precious metals do, keep an eye on the news, and plan ahead. Plan for what happens if there is more inflation. Plan for what happens if you lose your job. Have a plan if the U.S. and allies allow the Ukrainians to use cruise missiles to launch attacks deep inside Russia and Russia retaliates against NATO countries.

Planning and contingencies, whether or not they involve gold, will help put you in a better position to weather the coming storm, regardless of what it looks like