This article on why seniors need a bigger Social Security cost of living increase points out some very real price increase from 202 that affect everyone, not just seniors. While these rising prices no doubt make it difficult for senior citizens who rely on Social Security for their retirement income to continue to put food on their tables and keep their standard of living, the rising costs affect everyone.

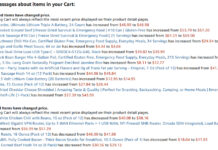

For those who cannot read the tiny chart in the linked article, let me reproduce some of the data. This is how much these items rose in cost for the first 11 months of 2020:

- Beef Roasts: 11.3%

- Pork Chops: 9.9%

- Poultry: 7%

- Tomatoes: 6.5%

- Canned Tuna: 6%

- Household Paper Products: 7.3%

- Used Cars & Trucks: 10.9%

In other words, if you felt that food prices were rising, you were right. And clearly, this is a side effect of the government’s response to Coronavirus.

Yet if you look at government data published Wednesday, they show annual consumer inflation at 1.4 percent in December. That’s quite a contrast and you can see how it would leave people in a big hole. Even people lucky enough to have jobs are unlikely to see raises high enough to cover some of the prices increases above.

More Inflation is Coming

Whether it will be reflected in government statistics or not, more inflation is coming. Economic experts will tell you that putting more money into the economy will cause a general rise in prices as more money chases fewer good. Due to the manufacturing disruption spawned by the COVID-19 shut-downs at factories and food processing plants, there are fewer appliances, meat, and other goods being produced. Fewer new cars were built in 2020 as many manufacturers shut down for months, which means both new and used car prices rose. Combine this with “free” money under the name of stimulus to individuals and companies and you have the recipe for inflation.

Quantitative easing (QE), or the government flooding the market with newly created dollars, is also expected to contribute to a rise of inflation. The money supply is an important part of the inflation equation and increasing the money supply will have ripple effects throughout the economy, inflating the stock market, creating zombie companies, and initiating inflation. Even tax legislation threatened by a Biden administration could cause inflation as people sell assets to generate capital gains taxes today when they are at a record low.

How to Protect Yourself

When I was a kid, Bazooka Joe bubble gun doubled in price from a penny to two cents. To protect myself from this price inflation, I bought 25 cents worth, which was an awful big purchase for something we usually bought one at a time at the corner store. Unfortunately, it didn’t last forever and I probably chewed it more often because it was on hand. Before long, I was paying two cents for my gum like everyone else. (I did, however, get to send in my Bazooka Joe points and get a switchblade comb.)

One way to protect yourself from inflation is to do what I did, but on a larger scale. Stock up things that are likely to get more expensive, like canned tuna, frozen chicken, and other goods that you will eat, consumer, or use up. This happens to have the side benefit of making your family more resilient in a survival situation because you will have a stash of food should the trucks stop rolling and the store shelves go bare.

While food has an expiration date, many items do not. For example, after we moved, I found boxes of facial tissues that we bought in preparation for Y2K. More than 20 years later, they still wiped up snot even if they are not quite as soft as those we buy today. You can stock up on motor oil, bar and chain oil for your saw, nails and screws, fencing and wire you know you will need in the future, ammunition for your guns, clothes for your kids, shoes for yourself, and many other things that will still be good if they sit on the shelf for a couple years.

Buying Tangible Assets

Finally, you can buy silver coins or other precious metals to help preserve your wealth. Real estate is also a good way to take money that may lose value during a period of inflation and invest in it a manner that will preserve its value. Let’s say that an acre of farmland is $3,000 so you buy 100 acres for $300,000. Then the United States experiences a wave of inflation and the value of the dollar drops. When the economy finally recovers, things that once cost $1 now cost $10. Ideally, you could sell that proper for $3 million. Even better, while you owned it, you could either raise crops to produce an income or rent or lease it to someone else who would.

Right now, we’re in a real estate boom, the price of gold increased 28 percent in 2020, silver increased 47 percent, and bitcoin is off like a rocket. Why? Because people are buying them as hedges against inflation. If the dollar is becoming worth less over time, they want to invest in something that will be worth more when measured in dollars. Real estate and precious metals have proven to be safe havens over time. Bitcoin is a big unknown but may also prove to be a safe haven.

Whatever your current financial situation, even the smallest steps to be better prepared for inflation can help you come out ahead. Prepare now before things get worse.