I know that we are luckier than many during this quarantine period. We are young enough that we don’t have kids at home we have to care for, yet not so old that catching the coronavirus would be a death sentence. We’ve been able to pay our mortgage and other bills. In fact, we’ve been saving money because we’re not taking road trips, eating out, or shopping. Our livelihoods don’t depend on a long supply chain, like the farmers who have to plow under their crops or the factories that shut down because parts from other factories in other countries have not arrived.

We don’t work in healthcare or other jobs where we are forced to expose ourselves to infection. The people we know who have caught COVID-19 have recovered. We are not hungry, cold, wet or even uncomfortable. And for all of this we are thankful and consider ourselves blessed.

Our biggest threat, outside he virus itself, is being forced into a stasis, a life where nothing much changes from day to day. This, I tell myself, is why astronauts on long trips in SciFi books and movies always freeze themselves, so that they don’t go mad confined to their tiny ships while the rest of humanity recedes into the distance. I may be an introvert, but I don’t envy the scientists who over-winter in Antarctica. While I don’t really miss people, I miss doing. I miss having projects and being active.

The Worst May Lie Ahead

From a medical perspective, we may have crossed the peak of this virus and are on a downward slope, but I think the worst lies ahead of us, and it will be economic, not medical. I am not enough of an expert to tell you whether we will experience deflation or inflation, or one followed by the other, but it doesn’t take an expert to tell you that bad times lie ahead.

They used to say that “When General Motors sneezes, the stock market catches a cold.” I would paraphrase that to say that when the United States sneezes, the rest of the world catches a cold because for years we have been the driving force behind global growth.

America is the engine of the world; we pull the train. We may not be the only engine, but we’re the biggest one. Germany and Japan are well behind us, as are the UK and France. China wishes they were an engine, but they are like the car right behind the engines, feeding wood into the steam engine. While their economy is large, it’s not self-sustaining. Without the U.S. pulling, China would drift to a stop, as would every other country that is being pulled along by the U.S. and our fellow engines.

To extend the analogy further, the problem China faces is that the U.S. plans to upgrade to diesel fuel, and over time that will lessen their sales.

What does the future hold? Here are my projections:

An Economic Crash

A slow economic recovery due to slow and inconsistent reopening schedules across the different states, plus a reluctance by many consumers to return to their former spending habits. We expect many people will choose to continue social distancing which will limit their spending and further slow the economic recovery.

Tourism and even business travel will also remain depressed, having a negative effect on airlines, hotels, cruise ships and AirBNB and VRBO hosts. Sporting events, concerts and other live events will be slow to bounce back simply because many people won’t want to be in a crowd.

A recent survey showed:

69% of Americans feel “extremely worried” about flying on an airplane again, taking a cruise (76%), going to a restaurant (62%), or using a ride-sharing service (58%). And more than half (53%) feel the same way about going to the hospital should they suffer a medical emergency during the coronavirus outbreak.

Of those afraid of going on a cruise, 43% anticipate the fear will last forever. The same can also be said for 21% of people worried about dining out.

Large, expensive items will suffer the largest decline, with durable goods taking a couple years to return to current levels. New car dealers will be hurt, but the manufacturers will suffer more.

A Housing Collapse

The home buying market will also face significant disruption as the number of first-time home buyers drops as a result of lost income. On top of that, many of the entrepreneurs who piled up debt to buy Airbnb properties are in trouble and trying to unload what were once money-making properties. Cities and towns that once said the vacation rental company was driving up real estate prices will find that they are now dragging them down by flooding the market at the exact time when have the country has seen their income drop.

People in urban settings who fear future outbreaks may try to move to the suburbs or beyond, driving up demand for larger homes and rural homes. This could also add to inventory in cities, driving down prices. And if people cannot afford to sell their existing homes, they won’t be buying a new one.

After the 2008 Grand Recession, unfinished condos and apartment buildings lay dormant for years as developers lost their funding. We expect to see that again, and that means a huge number of contractors and subs find themselves suddenly without work.

Skylines in booming cities like Austin, Texas, Charlotte, N.C., and Nashville, Tenn., will soon see a decrease in the number of cranes as hotels and large office building projects are put on hold. Lease rates for commercial properties will drop, both for office space and retail space. Shopping malls developers, already on shaky ground, may well suffer a complete collapse.

A Retail and Restaurant Apocalypse

I’ve written about how small businesses will be forced to close during or after the Coronavirus crises because what was once a viable business model fails when you have only a fraction of the customer base. They can lay off employees and cut back on services, but fixed costs will drag them down. Unless the business is an ice cream stand or on the boardwalk, they don’t plan for losing several months of income. And business interruption insurance policies don’t look like they will pay out.

Prior to the coronavirus, the retail sector was one of the top five job providers. Right now, the safest job in retail is probably at Walmart or your local grocery store.

Municipal Problems

Cities, counties, and states depend on tax revenues to provide services and programs, including mass transit, fire and police, public health, social services, etc. Not only have the costs related to coronavirus cut into budgets set aside for other services, but some governments came into this situation with hefty budget deficits, underfunded pension plans, and bloated bureaucracies.

The state and local government sector provides even more jobs than retail, and they are more secure, as well.

The Human Toll

When I worked in corporate America, there were always some savvy employees who would injure their back and go on disability whenever they sensed a layoff coming. Why? Because they couldn’t get laid off while on disability and got to go back to work when they miraculously recovered. This whole shut down came up to fast for them to pull that stunt, but the truth is employees across almost every industry will be hurt.

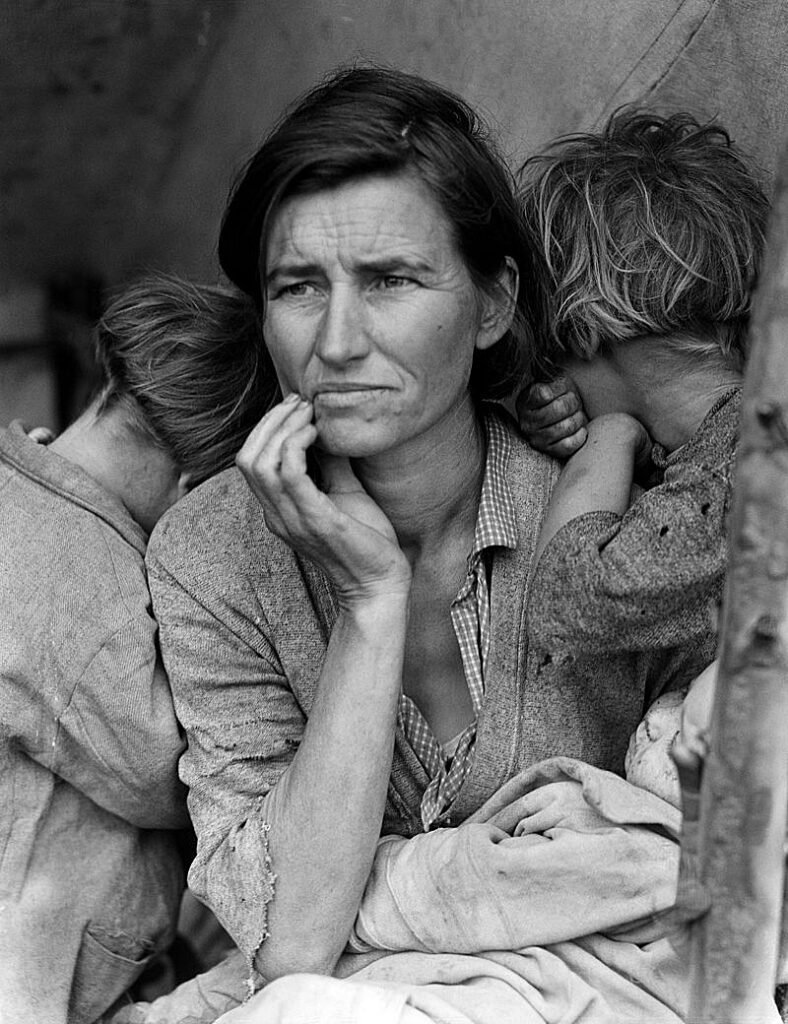

Unemployment has already hit record levels, and there’s no way everyone is going back to work right away. People who live paycheck to paycheck are going to lose their healthcare, their homes and possibly their cars. There will be more people living in shelters or in cars. Alcoholism and drug abuse will increase. Kids will find their lives disrupted, often at a critical time in their development, and drop out of school. And once derailed, it’s hard to get an education or a career back on track.

The increase in human suffering will be noticeable by the third quarter. If you can, make a donation to your local food bank, homeless shelter or other charity that helps care for people left behind when the economy suffers.

How to Protect Yourself

A family living self-sufficiently on a nice plot of land might be able to survive a crisis like this without even taking notice. That’s our goal and we hope to move towards it aggressively this year.

Otherwise, the best — and for many, the toughest — way to protect yourself in an economic crisis is to have savings you can fall back on if your income drops. People recommend six months of savings, but more is better. If you are lucky enough to have significant investments, than keep three to five years’ worth in cash or cash equivalents and invest the rest as you see fit.

If you have no savings, you need to immediately cut your expenses to the bone and start saving money. That means get the cheapest mobile phone plan available and don’t upgrade your phone. Dump your cable or satellite TV and trim your streaming services to one or two. Stop eating out and buy staple food items in bulk – things like rice, dried beans, pasta, oatmeal, flour, and fresh vegetables. Plant a garden and grow as much of your own food as you can. Even if you live in an apartment, you can grow sprouts or microgreens. Don’t buy processed foods but learn to cook from scratch and save and re-heat your leftovers. Don’t splurge, don’t buy anything news, and shop for most of what you need at Goodwill and other thrift stores. Consider selling things you can do without, or barter them for goods and services you do need.

If you do lose your job, apply for every plan social services offers, including unemployment and food stamps. If you have young children, apply for WIC, and if you don’t think your job is coming back, ask about job training.

To raise funds, consider selling plasma, babysitting, dog walking, house cleaning and other jobs that pay cash. Even in the worst economy, someone will be making money, and they’ll still need services.

If you’re lucky enough to live through COVID-19, don’t let the coming economic crash ruin your life

Other entries in our Quarantine Diary are available in chronological order.