My wife came home from grocery shopping last week and informed me that prices are rising. I agreed and told her that food inflation was hitting 10 percent in some categories.

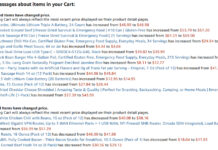

For the past few months, I’ve been warning you about inflation: Food inflation, fuel inflation, ammo inflation, and inflation because of shortages caused by supply chain problems. An article in the Wall Street Journal adds yet another cause of inflation: Chinese companies are raising their prices in part because of higher commodity and shipping costs.

If you are not seeing inflation in your grocery shopping, you will see in in goods made from China. Chances are, you will see it in both, and in many other goods and services as well.

Houses are Also More Expensive

While rents in places like New York and San Francisco are dropping, the cost of houses is rising. We are not the only ones who sold their house for more than its listing price. Here’s a story about a house in Sacramento that received 122 offers in just two days, one of them for 25 percent more than the sale price. That’s not just inflation, that’s irrational exuberance and a bubble.

This article showing how the CPI does not accurately measure housing inflation is chick full of valuable information about housing inflation. it also goes into detail on how the government minimizes the true inflation rate and why this should concern you.

What Higher Taxes Will Mean

When Biden started using the phrase “Build back better,” he didn’t tell you that he will build your taxes. Although they claim the new taxes will affect only those earning more than $400,000, that is a fallacy.

I have worked in enough companies to know that when a company has to pay more (for raw materials, for labor, for taxes, etc.) they pass that cost of doing business on to the customer. Who is the customer? Lots of people who make less than $400,000 per year.

So while the government may not charge you additional taxes, the companies will build the cost of those taxes into everything you buy. And what will those rising costs look like? They will look like inflation.

What Steps You Should Take

If you plan to make any large capital expenditures, my advice is to not wait but spend your money now. If you plan on buying a new house, renovations, a new car, new appliances, new guns, new tools, etc., don’t wait a year.

As a prepper, if you are considering building an outbuilding, buying livestock, expanding your garden, buying a new tractor or another piece of equipment, my advice would be to do it now.

I don’t generally recommend borrowing money, but if you borrow money for any of your acquisitions, make sure you borrow at a fixed rate. Borrowing at an adjustable rate will just drive your costs up as inflation rises.

I bought eight sheets of T1-11 to use for the side of our chicken coop and the cost shocked me. I could buy a lot of eggs for the price of a a sheet of plywood. Lumber has increased 180 percent in the past year, according to this article from Quartz. It points to COVID-19, the demand for new houses, and the impact of a beetle on Canadian forests as the reason for rising prices.

As much as I hate to pay about three times what lumber cost a year ago, my fear is that it will be even more expensive if I wait another year.