Let’s fast-forward six months or a year and imagine that the country remains in the grips of a wave of inflation. The amount of money you spend weekly to put food on your family’s table has increased 50 percent. Gasoline is $5.39 a gallon. It cost $1,350 to fill your propane tank and you know you usually have to fill it at least three times over the winter. You don’t have to be a budgeting genius to realize you have to do something different or you will run out of money leaving your belly, your gas tank, or the propane tank empty.

What will you do?

First, don’t panic. It accomplishes nothing and leads to despair. There are steps most families can take to reduce their expenditures, and hopefully you only have to do it for a couple years before things stabilize and your financial situation improves.

Second, you must accept the fact that you cannot continue to live like you have been. Some sacrifices will need to be made and the sooner that you accept that and move on, the better. It’s going to be an adjustment, but it’s better to pick where you will sacrifice rather than going hungry when the cupboards are bare.

Lifestyle Changes

Inflation is going to force you to accept some lifestyle changes. These include things like:

- Not eating out. Pack a lunch and don’t buy coffee at Starbucks or anywhere else. Make your meals at home (see more on this, below).

- If you go on vacation, make it nearby so you can drive and as inexpensive as possible. Visit friends and relatives who can put you up rather than staying in hotels. Tent camp in a wilderness area rather than paying for a campsite. Go on day trips, take a picnic lunch, and visit local sites instead of undertaking costly travel.

- Don’t go to entertainment that charges admission, but look for free activities and events like concerts in the park.

- Entertain friends at home with a meal, cook out with neighbors, or host game nights with pot luck food instead of going out to places that have a cover charge or sell you alcohol at an enormous mark up.

Don’t Buy Anything New

Television has conditioned us and peer pressure has reinforced our need to buy the newest, biggest, and best items, but that’s often unnecessary. Consider buying everything you can used, from previously owned cars to refurbished computers and electronics.

The sad truth is that people die every day and they leave behind a house full of goods. Their kids, assuming they have any, probably only want a few heirlooms. They don’t need or want their TV, dining room set, or all the tools in the garage. Other people move, downsize, or combine households and have to eliminate some of their belongings. If you can get over the idea of buying something used, you can save a great deal of money and keep items out of the landfill.

Other people have a bad shopping habit and buy things, wear it once or not t all, and then donate it. You can

Here’s how to get started:

- Stop going to retailers that sell new goods, and shop at thrift stores, Goodwill, Restore and other places that sell used items, often at very low prices. Buy new underwear, socks and maybe shoes, but get everything else pre-worn.

- Seek out specific items at flea markets, estate sales, and pawn shops. Don’t be afraid to bargain and make counter offers.

- Put your kids in hand-me-downs instead of new clothes. Reach out to family and friends who have kids just above or below the age (and size) of your kids and exchange clothing or pass them on. Most young kids grow so fast that they don’t wear out their clothes, so they have plenty of life left.

- Consider buying used small appliances. I’ve used microwaves and toaster ovens from thrift stores, and we purchased our dehydrator at Restore. Sometimes old vacuum cleaners are actually more powerful than new ones and you can often get great buys on sewing machines.

- You can also buy used appliances from scratch-and-dent sales. Sometimes small engine repair places will sell you old but repaired lawn and garden equipment.

- Buy used furniture, exercise equipment, tools, and other items on Craigslist, freecycle and similar websites. When we downsized into our current house, we gave items to friends and family, but we also unloaded furniture on Craigslist and dropped off loads of stuff to Restore.

- Our local dump has a place where people set stuff that is too good to be tossed in a dumpster. Check it out every time you drive by and you may find something worth having.

- If you have not already done so, ditch your cable TV and limit yourself to one steaming service. I recommend you change services every four to six months rather than pay for four or five at once. Watch all the shows you want on Netflix, then cancel and join HBO Max, Disney or another service for a few months until you’ve seen everything they offer.

- Eliminate all the other subscription services you have because they just syphon money out from under you. This includes online services and services that send you products. Eliminate any box plan where you get a box every month for “evaluation.”

- Look for a cheaper cell phone carrier and don’t get suckered into paying an extra $20 a month (or whatever) for the opportunity to upgrade to the newest phone.

Take Advantage of Free Things

- Go to the library. Not only will they have books you can read for free, many of them offer DVDs and CDs.

- Visit the website for your local tourist board or chamber of commerce. They often maintain an extensive list of free activities, from street fairs to concerts.

- If you enjoy the theater, volunteer to be an usher and help show audience members to their seats. You will get to watch the show for free.

- Look for museums that are free or accept a donation rather than an entry fee.

- If your kids are teenagers, sign them up to be counselors at camp. Sure, they have to watch a group of younger kids, but they get to use the same facilities and have many of the benefits of the paid attendees. If it’s a sleep-away camp, they’ll get room and board and a salary or stipend.

- Listen to AM/FM radio instead of paying for satellite radio or a paid streaming service. If you must have streaming music, join a free service and don’t upgrade.

- If you live in an area with broadcast TV, you can still pick up plenty of free local network affiliate stations by using an inexpensive antenna.

- Stop using a dryer and switch to a clothes line. It would shock you to see how much electricity it takes to dry your clothes.

- Don’t pay for expensive software when there are free or open-source apps available that will do 99% of what the expensive from Microsoft and Adobe do.

Change your Eating Habits

Food is something you have to have, but you don’t have to eat the same way you do today. You may have to take longer making meals, but you can save money by doing so and have healthier food.

Here are some suggestions for changing your grocery shopping and your eating habits to save money:

- Stop eating prepared foods and start cooking from scratch. Make casseroles, soups, stews, pastas, and similar dishes. Refrigerate your leftovers and serve them again two days later or freeze them and eat them weeks later.

- Buy a big bag of flour, another of cornmeal, and one of sugar. Then buy some yeast and baking powder. You now have the ingredients necessary to bake your own bread, cornbread, tortillas, rolls, pancakes, biscuits, waffles, etc.

- Don’t throw out food unless it tasted terrible, has rotted or is so old it might be dangerous to consume. If you have leftover vegetables at night, stick them in the freezer. When you have accumulated several items, use them in soup or stew.

- Serve less meat. Include it as an ingredient rather than a main course. Mix meat with root vegetables in soups or stews. Think spaghetti or lasagna with meat sauce rather than meatballs. Don’t give everyone a couple slices of bacon or sausage patties at breakfast. Instead, mix half as much into scrambled eggs and make an omelet or a breakfast burrito. This can reduce your meat consumption by 50 percent or more.

- Become an expert at making rice and beans and always use dry beans bought in large quantities, which as a prepper you should be stocking. There are plenty of good bean recipes from the South where pinto beans were once a staple, but look also at other cultures that use rice and beans, including Hispanic, Indian, and Middle Eastern. You can substitute corn or cornmeal for rice and have the same healthy balance of nutrients.

Shop for Food in New Ways

In addition to what you buy and how you eat, reevaluate where you shop and how you shop for food. You may need to stop shopping at your favorite store or change your buying habits.

For example:

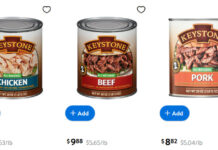

- In many cases, the smaller the store, the more the cost of groceries. That means it is cheaper to buy in quantity at Costco or Sam’s Club, which is cheaper than the neighborhood grocery, which in turn is cheaper than the convenience store or local corner store. Our research has shown that Walmart really does have low prices if you buy traditional-sized items. If you have a large family or can afford to buy large quantities, membership at a club store can be worthwhile.

- When costs rise, put a greater emphasis on using coupons and buying items on sale. If you live in an area with multiple grocery stores, peruse their circulars online before shopping to find out where you can get the best buys. When an item you use frequently is on sale, stock up. Take advantage of loss leaders like eggs.

- When available, buy generic and store-brand items instead of the big brands. Even if this only saves you 10 percent, that allows you to buy 10 percent more calories or use that savings on other important items.

- As important as what you buy is what you avoid. Don’t spend money on empty calories such as soda pop, flavored waters, energy drinks, candy, cakes, muffins, chips, snacks, and donuts. Limit or eliminate your purchase of products that have sugar, corn syrup or other sweeteners as their first or second ingredient.

- Buy foods that will not only make you feel full but will stick with you throughout the day, such as whole wheat or multi-grain breads. (Although baking your own bread is usually cheaper.)

- Avoid items that are out of season and have to be shipped from Brazil. This may include fresh fruits and berries. Buying items in season when they are cheap and preserve them via freezing, canning or dehydrating.

Look into Alternative Food Sources

We are accustomed to buying food at grocery stores, but there are other sources that should not be overlooked:

- Your best bet is to grow or raise your own food in a backyard garden. This is not a gardening website, but you can find plenty of advice on the web and via YouTube on starting a garden even if it is only a container garden. Don’t concentrate on common items like tomatoes and peppers, but look at potatoes, carrots, turnips, cabbage and Jerusalem artichoke, which can over winter.

- If you don’t have room for a garden, consider raising mushrooms in your basement. Another alternative is to grow sprouts or microgreens.

- Consider pressure canning produce, either what you grow yourself or you can buy for less when in season. It may be cheaper to buy a bushel of peaches or a basket of apples from a farm stand or farmer’s market and preserve them than to buy canned peaches.

- Small livestock like chickens and rabbits can be raised almost anywhere and pigeons were raised on rooftops for much of the 20th century. These can be a useful source of food as well as items that can be useful in barter, as discussed in yesterday’s post. If you have a bit of pasture, you can raise 50 meat chickens or a few pigs which will help feed your family.

- Ask your grocer what they do with day-old bread. Does it go on sale or do they donate it? One day when shopping late after my daughter’s soccer match, we learned that the local grocery store prints out sale labels for meats and baked goods that re a day away from expiring at 7 p.m. By 8 p.m., they marked most of the items down. We saved so much that we made it a habit to shop late in the evening.

- Look for thrift bakery stores, sometimes called “dead bread stores,” where you can buy baked goods that are close to or past their best buy dates. These stores may also carry overstock items. I’ve seen these branded with the Wonder Bread or Hostess logos and even a Pepperidge Farm outlet. If you don’t find something for yourself, many people get garbage bags full or old food to feed their pigs.

- Hunting, trapping and fishing can also provide alternative sources of healthy lean meat. Yes, you can go after game fish, but don’t ignore smaller pan fish. A bluegill or crappie may not look like much, but when you can haul in a couple dozen in an afternoon, you suddenly have enough for a fish fry and more for the freezer. Plus, the fish heads can be used to make fertilizer or fed to your pigs or chickens.

- You can also forage for wild plants. Get a library book on harvesting wild plants in your area and you can combine some exercise and fun with your foraging. If you can find a local expert and accompany them on a trip, even better.

- Look into local food pantries that will give food to families who cannot afford it. Some of these are small and sponsored by a local church. Others are large and take place in big parking lots.

Ask for Assistance

If you are struggling financially because of inflation, unemployment, a layoff, or other misfortune, you need to swallow your pride and ask for help.

- There are many government programs that are part of the safety net and will provide food, rent, help with utilities, and help for people who are struggling. Don’t be embarrassed about taking advantage of these services. Chances are that you paid taxes into the system for years; now it’s time to get some of that money back.

- If your kids are in a public school, try to get them on the free lunch program. Taking part in that program may make them eligible for other programs, including those that provide school supplies and food over the summer.

- If you are a member of a church, they may have a program to help parishioners who are down on their luck. Some churches will also help non-members or run special housing programs.

- If you have parents or other family members who are wealthy, or at least better off than you, ask them for help. If you cannot bring yourself to ask for money, ask your parents to take the kids for a couple weeks in the summer. Or maybe tell them you cannot afford a vacation, and as if you come and stay with them for a week or two this summer?

If someone offers you help, humbly and graciously accept it. When things are better and you are able to do so, you can play it forward.

Other Things You Can Do

- If you are young, consider joining the military. They not only pay you, but give you room, board, medical care, and often allow you to pick the training you want. You don’t have to be in the infantry or drive a tank. There are plenty of jobs in logistics, accounting, electronics, communication, and mechanics that will be valuable after you get out. Your spouse and children may also qualify for benefits.

- Work on a cruise ship. This can be hard work and you have to smile and be nice to rude people, but if you have no money and are single, it’s a job that comes with room and board.

- If you are too old and settled down for either of these options, get a part-time job in addition to your regular job. Look for things you can do from home with little or no training, like providing customer service via phone, online chat, or email. Be sure to look for a job that pays by the hour, not the customer, because you want to get paid even when it is slow.

- Develop a side gig. We know a young woman who made $700 a week walking other people’s dogs while she was going to college full time. Consider house sitting, which may include pet sitting and dog walking. If you have a unique skill or ability, put it to work. For instance, you could tutor someone’s kid, teach music lessons, or help them improve their tennis game. If you do a good job, are personable, polite, and show up on time, you’ll probably end up with more referrals than you can handle.

Implementing just a few of the above suggestion can make a difference, but as inflation gets worse, you may need to cut back more and more. Follow the general tips in here, stock up when something is on sale, stop buying new items when a used one will do, and you should come out the other end ahead of the pack.