When COVID-19 first started out, we covered it almost every day. These days, I feel I am covering inflation every day. That may be a reflection how serious it is. While the coronavirus threatened our health, Inflation threats our wallets, and in the end it will probably impact more people than the virus itself.

Today’s news is worth covering, as new government figures show inflation is growing at 5 percent, the fastest rate since 2008. Core inflation, which is when you remove the volatile food and energy categories, grew 3.8 percent, the fastest in three decades. All across the CPI data, categories set records for growth.

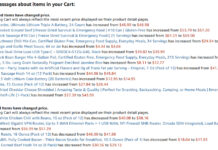

According to the Wall Street Journal, restaurants like Chipotle, Shake Shack, and Cracker barrel are raising their prices. For those that don’t eat out, companies that supply food and household goods are also raising prices. We’re talking big brands that dominate grocery store aisles, like Campbell Soup, Unilever, and General Mills.

About the only thing that could stop inflation now would be a good, solid recession. Talk about having to choose between two evils.

The Government May Want Inflation

By looking at the tremendous borrowing and spending, you almost have to wonder if the government wants inflation. My guess is that they probably do, for two reasons.

First, inflation makes us all poorer. Our money buys less, dragging the lower middle class below the poverty line and making them more dependent on government handouts. That’s what socialists want. They don’t want citizens to be free and independent. They want you to be dependent—on them. Socialists want to tell you what you can and cannot do. (Look at Chine if you are in doubt.) They want you to toe the line. Eroding the middle class is one way to achieve that.

Second, it’s easier to pay off old debts with inflated dollars. Also, as prices rise, so will our GDP. That could allow even more borrowing as our debt to GDP ratio drops.

Only a politician who doesn’t want what is best for the country would endorse plans that lead to inflation. As this headline says, “Latest Economic Figures Shows Bidenomics is not Working.” In my book, that’s just another way of saying: Socialism doesn’t work.

Is Biden the Next Jimmy Carter?

Jimmy Carter may be considered an “elder statesman,” but among those of us who remember his term first-hand rather than knowing of it only from a public school education, the former peanut farmer is known for two things: The Iranian Hostage Crisis and Inflation.

Joe Biden will probably share that fate.

When Inflation Hits, Turn to Barter

When inflation strikes, it’s time to start looking at two things: What skills, services, or products can you offer in trade, and what can you do without?

As you know, I am planning to produced eggs and honey for barter. I may also raise rabbits or run a trap line to produce food or furs that can be sold or traded. If things get to the point where the dollar has no real value, I can carefully use some of my stored ammo as an alternate currency. I also have other skills I can trade upon.

I strongly encourage you to read our post “How to Prosper in a Barter Economy.” The time may come when you need to save your cash for gasoline or medicine. Being able to barter might be the only way you can afford something like a haircut, a car repair, a computer upgrade, or a case of mason jars.

Cutting Back

Inflation is going to put a dent in budgets. It will take time before raises and cost-of-living adjustments increase your income, and even then it is unlikely to match the actual pace of inflation. You may find yourself being able to afford less and less as inflation eats away at your buying power. Whatever you do, don’t put things on credit cards you cannot afford to pay off. Instead, cut back. Spend less. Give up things that cost money.

There are plenty of things that you can do to reduce your monthly costs. Check back tomorrow for a detailed article on how to live more frugally.