I hope you live in a state where the amount your utility companies can charge you is controlled by a state commission because it could delay the inevitable rising price you will pay for gas and electricity.

If you have a long commute by car or a job that keeps you on the road, it’s time to get another job, a more efficient car, or become a remote worker. The cost of oil is heading upwards, and you are going to feel that at the gas pump pretty soon. We are entering one of those periods where every week the price is higher than the last time.

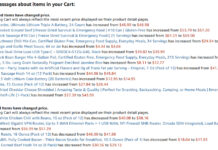

We are in the early stages of those rare moments when you can see inflation happening right in front of your eyes. It’s going to very visible for gasoline, energy, and food, but everything will be more expensive in six months than it is today.

It’s a Global Problem

I’ve posted about the problems in the UK and, to a lesser extent, in Europe due to limited supplies of natural gas. The problem is spreading to China, where the government has ordered its state-owned energy companies to secure sufficient supplies of fossil fuels to last the winter “at all costs.” The intent is to prevent blackouts, which piss off the populace, and a pissed off populace is the last thing a shaky government needs.

That part about “at all costs” means “at any cost,” because China will pay more to buy coal and natural gas. That added demand and bigger checkbook will drive up the price for coal and natural gas everywhere, beyond where they are to date. Having China compete for limited supplies of liquefied natural gas (LNG) is going to hurt Europe the most, but we’ll see prices uptick here.

Keep in mind that when electric blackouts hit, manufacturing comes to a stop. If it is a complex manufacturing process, it can take days or even weeks to re-start. If you think the supply chain is bad now, wait until the factories in China can only produce three or four days a week or factories elsewhere have to cease production due to a lack of power or raw materials.

Energy Hyperinflation

In the UK, the high price of natural gas has already caused plants to halt production, endangering the supply of fertilizer and carbon dioxide. It is so bad in Europe that the word “hyperinflation” is already being used to describe the “surreal” gas and electricity prices there, which have doubled in the past month. It looks like this winter will make it even more hyper, if that’s a thing.

If you think the U.S. is immune from energy problems and hyperinflation on another continent, think again. It’s a global economy. We will feel some effects from our trading partners.

The U.S. Could be Part of the Solution

As oil and natural gas prices rise, the U.S. could be part of the solution if constraints imposed by Joe Biden on companies that explore, drill, and pump oil and gas are removed. We became energy independent under Trump, but Biden and the socialist’s green agenda put an end to that on his first day in office. Fracking all but closed down. He forced the closure of The Keystone Pipeline and put restrictions in place on off shore drilling. That not only cost thousands of jobs but millions of barrels of oil per day.

Gasoline around here went from $1.89 on Election Day to more than $3 now. The Biden Administration could reverse that by reversing a few decisions and relaxing a few new executive orders. I doubt they will; they don’t care about how much you spend on gas. I take that back; they do care. They want gasoline to be expensive to encourage you to buy an electric car.

China is encouraging its miners and driller to produce more coal and gas. We should do the same.