The United States surpassed 200,000 deaths due to COVID-19 yesterday and is just a day or two away from 7 million total cases. To put that in perspective, that’s about 21 percent of global deaths and 22 percent of worldwide cases. Heart disease and cancer are responsible for several times as many deaths. By Year-end, Coronavirus will probably account for only 9 or 10 percent of all deaths in the U.S. in 2020.

While cases are trending higher again, increased testing and college students are reportedly to blame. Deaths continue to trend downward and there has not been an increase in hospitalizations. Unlike Australia, Israel, the UK, and parts of Europe, it doesn’t look like the U.S. is heading back into a shutdown.

As this article from Bloomberg discusses, colleges are “reservoirs” of infection and when students go home, they could be responsible for spreading the disease as we head into winter.

More Closures and Bankruptcies

Driving into the city for an appointment, I noticed that the BatteriesPlus store where I went to buy special batteries is gone. The sign has been removed from the shopping center and their spot in the building is empty, like they never existed. We also heard from a friend closer to the city that a restaurant where we enjoyed brunch maybe six or eight times a year shut down. These are just a few of the COVID-19 shutdowns we have seen locally.

And it’s not just retailers and restaurants that are hurting. Food inflation after the outbreak affects 85 percent of consumers.

What is worse than the increase in prices is that it means we may be seeing the start of inflation, which insidiously eats away at the buying power of Americans. Inflation is like a hidden tax, forcing you to use up more money on necessities and have less left to save or spend on non-essential items. We have an article that might be of interest: 27 Ways to Save Money on Groceries.

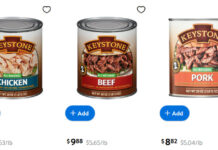

One thing to do to get ahead of inflation is to buy as much as you can NOW, before prices rise further. Stock up. It may help you prepare for the worst and it will help you reduces future expenditures.